LONDON, UK, March 24, 2020 /CNW/ - Seaspan Corporation ("Seaspan"), a wholly owned subsidiary of Atlas Corp. ("Atlas") (NYSE: ATCO) announces the delivery of the first of four vessels to be acquired pursuant to a previously announced acquisition agreement (the "Acquired Vessels"). In connection with the delivery, Seaspan has closed one of four innovative finance lease transactions (the "Financings") with total proceeds of approximately $340 million, in partnership with a leading financial institution. At the conclusion of the initial 10-year term, Seaspan is obligated to purchase the vessels at a predetermined price. The closing of the remaining three Financings are with the same financial partner and are subject to identical terms and conditions. In addition, these vessels have pre-determined delivery schedules according to our vessel sale and purchase agreement.

Highlights of the Facilities

- 10-year tenor extends and diversifies Seaspan's maturity profile

- Innovative structure provides collateral flexibility

- Attractive total cost of debt on long-term committed capital

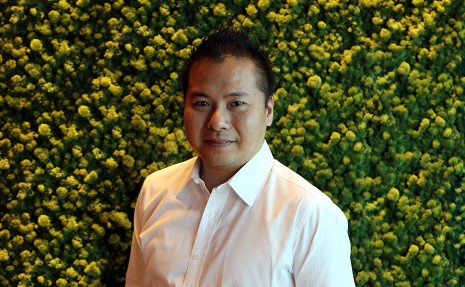

Bing Chen, President & CEO of Atlas, commented, "Despite the current extraordinary market condition, Seaspan not only maintains access to the global capital markets, but also continues to develop our innovative and mutually beneficial solutions with our financing partners. As the largest and the best-in-class containership owner and operator, our unique business model with predictable cash flow is the best testament to our financial resilience in this turbulent market. I am proud of our team's consistent execution in delivering quality growth and investing in our integrated platform, which is supported by $4.6 billion of contracted revenue, 4.2 years of average remaining contract life, and creative partnerships with our top global liners."

Ryan Courson, CFO of Atlas, commented, "Increasing Atlas' access to capital is a critical element of our long-term strategy. This innovative, long-term, and flexible financing program supports Seaspan's high quality asset portfolio while improving Atlas' long-term credit profile. Our strong financing partnerships and diverse access to the capital markets provides our customers with confidence in Atlas' execution capabilities."

About Atlas

Atlas Corp. ("Atlas") is a leading global asset management company differentiated by its integrated platform as a best-in-class owner and operator with a focus on deploying capital to create sustainable shareholder value. Atlas' wholly-owned subsidiaries, Seaspan and APR Energy ("APR"), are unique, industry-leading operating platforms in the global maritime and energy space.

For more information visit atlascorporation.com

About Seaspan

Seaspan is a leading independent owner and operator of containerships with industry leading ship management services. We charter our vessels primarily pursuant to long-term, fixed-rate, time charters to the world's largest container shipping liners. Seaspan's fleet consists of 123 containerships, including four vessels the Company has agreed to purchase, which have not yet been delivered, representing total capacity of approximately 1,023,000 TEU. Seaspan's current operating fleet of 119 vessels has an average age of approximately seven years and an average remaining lease period of approximately four years, on a TEU-weighted basis.

For more information visit seaspancorp.com

Cautionary Note Regarding Forward-Looking Statements

This release contains certain forward-looking statements (as such term is defined in Section 21E of the Securities Exchange Act of 1934, as amended) concerning future events, including forward-looking statements regarding closing of the Financings and Seaspan's ability to continue to grow and lead the industry. Statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as "expects", "anticipates", "intends", "plans", "believes", "estimates", "projects", "forecasts", "will", "may", "potential", "should", and similar expressions are forward looking statements. These forward-looking statements reflect management's current expectations only as of the date of this release. As a result, you are cautioned not to rely on any forward-looking statements. Although these statements are based upon assumptions we believe to be reasonable based upon available information, they are subject to risks and uncertainties. These risks and uncertainties include, but are not limited to: the potential for delay in the closing of the Financings or that one or more conditions to closing are not satisfied; the potential that we will not be able to capitalize on opportunities in the containership sector or that there will be fewer opportunities given current world events; the possibility that we will not be able to execute on our growth strategy; and other factors detailed from time to time in our periodic reports and filings with the Securities and Exchange Commission, including Seaspan's Annual Report on Form 20-F for the year ended December 31, 2018. We expressly disclaim any obligation to update or revise any of these forward-looking statements, whether because of future events, new information, a change in our views or expectations, or otherwise. We make no prediction or statement about the performance of any of our securities.

Investor Inquiries:

Bill Stormont

Investor Relations

Atlas Corp.

Tel. +1-604-638-7240

Email: [email protected]

SOURCE Atlas Corp.