Further Strengthens Company's Capital Structure

HONG KONG, CHINA – Dec. 30, 2013 /CNW/ – Seaspan Corporation ("Seaspan") (NYSE:SSW) announced today that it has entered into an agreement to extend and refinance its $1.0 billion credit facility. BNP Paribas Securities Corp. acted as the lead arranger of the amended facility.

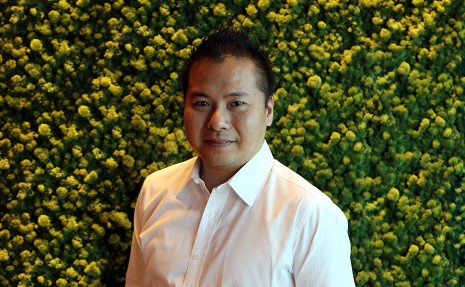

Gerry Wang, Chief Executive Officer, Co-Chairman, and Co-Founder of Seaspan, commented, "We appreciate the strong support we continue to receive from leading global banks and are pleased to have successfully refinanced the $1.0 billion facility ahead of the maturity date and under attractive terms. The refinancing provides multiple benefits for Seaspan and its shareholders, as we extended the maturity of the facility and decreased our total debt position, enabling the Company to further strengthen its capital structure. We believe we remain well positioned to continue to capitalize on a compelling acquisition environment, while utilizing our growing asset base and cash flows."

Under the terms of the amended facility and effective January 31, 2014, the maturity date will be extended from May 2015 to May 2019 and the outstanding amount of the facility will be reduced to approximately $435 million and bear interest at market terms. Seaspan intends to fund this payment by drawing amounts under an existing refinancing facility, which will be secured by certain ships currently pledged as collateral under the $1.0 billion facility, and with its substantial existing liquidity. In connection with entering into the amended credit facility, the Company is amending an existing interest rate swap arrangement to more closely correspond to the terms of the amended facility.

About Seaspan

Seaspan provides many of the world's major shipping lines with creative outsourcing alternatives to vessel ownership by offering long-term leases on large, modern containerships combined with industry leading ship management services. Seaspan's managed fleet consists of 104 containerships representing a total capacity of over 790,000 TEU, including 31 newbuilding containerships on order scheduled for delivery to Seaspan and third parties by the end of 2016. Seaspan's current operating fleet of 71 vessels has an average age of approximately seven years and an average remaining lease period of approximately six years.

Seaspan's common shares, Series C preferred shares and Series D preferred shares are listed on The New York Stock Exchange under the symbols "SSW", "SSW PR C" and "SSW PR D", respectively.

Forward-Looking Statements

The statements in this press release that are not historical facts may be forward-looking statements, including statement about the amended credit facility and its benefits to the Company. These forward-looking statements involve risks and uncertainties that could cause the outcome to be materially different. These risks and uncertainties include, among others, performance by counterparties to the amended loan documentation and those discussed in Seaspan's public filings with the SEC. Seaspan undertakes no obligation to revise or update any forward-looking statements unless required to do so under the securities laws.